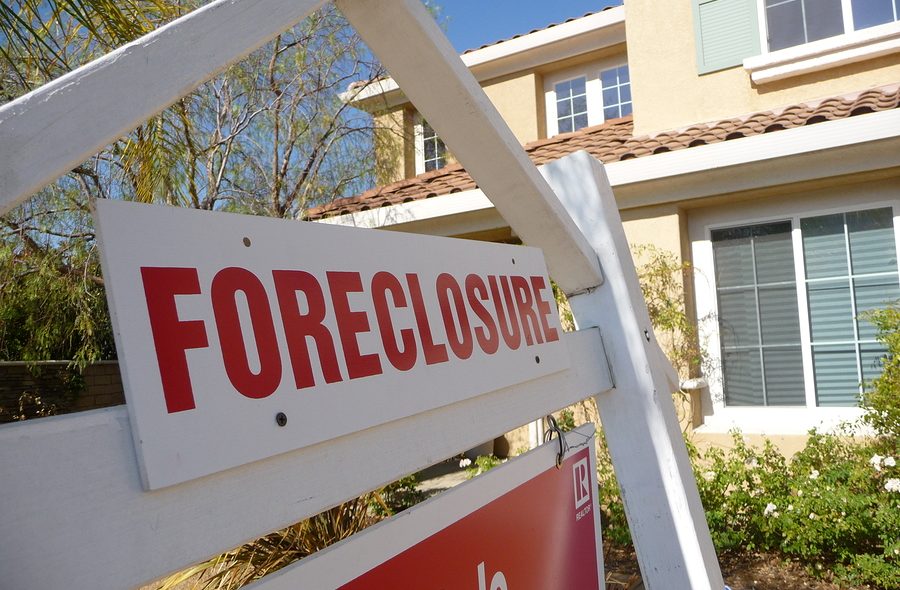

Glen Rice, former Miami Heat player and his ex-wife Cristy, who starred on The Real Housewives of Miami, are facing the loss of a downtown condo they still own together. Miami-Dade County records show the couple quit making payments on the condo they purchased in 2006 as an investment, following Glen’s retirement from the Los Angeles Clippers after 15 years in the NBA.

Property records show Glen and Cristy paid $317,000 for the condo, which is on the 27th floor of the Neo Vertika building on SW 1st Ct. in downtown Miami. Reportedly, the couple took out several mortgages on the condo totaling $500,000.

M&T Bank’s loan is supposed to be paid back at the rate of $1,401 a month. According to the lawsuit, the Rices stopped making payments in February. Cristy’s lawyer struck back at the bank with a defense claiming M&T has not followed the proper procedures in the foreclosure attempt.

The Rices’ originally filed for divorce in 2006. The couple also owns a $468,000 suburban home together. Glen Rice played for the Miami Heat from 1989 to 1995.

Click here to read more on this story.

Choosing the right attorney can make the difference between whether or not you can keep your home. A well-qualified Miami foreclosure defense attorney will not only help you keep your home, but they will be able to negotiate a loan that has payments you can afford. Miami foreclosure defense attorney Timothy Kingcade has helped many facing foreclosure alleviate their stress by letting them stay in their homes for at least another year, allowing them to re-organize their lives. If you have any questions on the topic of foreclosure please feel free to contact me at (305) 285-9100. You can also find useful consumer information on the Kingcade & Garcia website at www.miamibankruptcy.com.