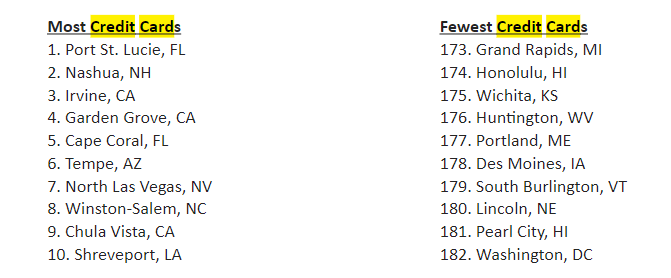

The average person has more than four different credit cards in their wallet, according to WalletHub’s proprietary data. People in some cities have more cards than others. The average in the top cities being over six cards per person. To determine the cities where credit card ownership is increasing the most, WalletHub analyzed the latest consumer-finance data across four key metrics. These metrics measured the average number of credit cards owned per person and average number of new cards opened per person in Q4 2023, as well as the percent change in both of those numbers from Q4 2022.

In total, Americans have over $1.2 trillion in credit card debt as of Sept. 30, 2023. Miami ranked No. 1, with an estimated payoff time of nearly 111 months — over nine years on average. Some of the reasons for the enormous timeline are the city’s high median credit card debt ($3,106) and relatively low median earnings for workers ($38,823), researchers explain. Several other Florida cities ranked near the top of the list for the least sustainable credit card debt, including Port St. Lucie (No. 4), Cape Coral (No. 5) and Tallahassee (No. 10).

If a person is struggling with credit card debt and is unsure of which route to take, it is always best to consult a legal professional to discuss his or her options. An attorney can look at the person’s situation and can advise him or her on whether bankruptcy is appropriate or whether other options are best.

As bankruptcy attorneys, we see credit card debt as one of the most common problems facing those with serious financial challenges. It is not surprising with the high interest rates, unreasonable fees, harassing debt collection calls, penalties and never-ending minimum payments that do not even make a dent in your actual debt.

Filing for bankruptcy is a viable option for those struggling with insurmountable credit card debt. Chapter 7 is the fastest form of consumer bankruptcy and forgives most unsecured debts like credit card debt, medical bills, and personal loans. There are certain qualifications a consumer must meet in regard to income, assets, and expenses to file for Chapter 7 bankruptcy, which is determined by the bankruptcy means test.

Click here to read more.

Sources:

Cities with the Most Credit Cards (wallethub.com)

Cities with the least sustainable credit card debt (wallethub.com)