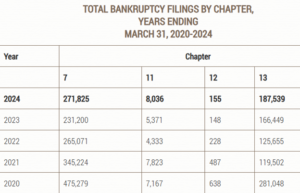

Several economic indicators point to a recession, including declining stock prices and a weakening consumer outlook. Consumer inquiries about bankruptcy surged during the first quarter of 2025 to the highest level since early 2020, reports LegalShield, which predicts “a potential wave” of bankruptcy filings this summer.

What do economists rely on to predict a recession? There are 10 indicators, some of which have been weakening before President Trump announced his tariff policy.

Shifting Stock Prices. In the aftermath of Trump proposing higher tariffs on April 2, the S&P 500 has dropped sharply, down 6% just in the two-plus weeks since then. Lower stock prices reflect declining consumer and business confidence.

Uptick in Foreclosures & Real Estate Trends. Certain real estate segments have shown weakness, with office buildings among the most stressed. A new sentiment survey among real estate investors, compiled by RCN Capital and CJ Patrick Co., dropped to its lowest level since it was started two years ago. The survey takes quarterly readings of optimism or pessimism among investors in residential properties.

Employment Uncertainty. The unemployment rate stood at 4.2% in March. While those numbers are not bad, jobless rates are not a leading indicator for predicting the direction of the economy. However, if the economy does take a dive, unemployment rates will start climbing.

Credit and Interest Rate Movements. With inflation expectations rising, due to higher tariffs, the Federal Reserve is likely to face a tough choice between trying to boost economic activity while trying to keep inflation at bay.

Consumer Outlook and Expectations. Consumers are feeling uneasy about the economy, and that is showing up in the data. Even before Trump’s tariff announcements, consumer expectations were the component that weighed down the leading indicators index. Since then, things have worsened. A more current indicator of consumer sentiment tracked by the University of Michigan showed substantial drops in confidence as of early April, as people prepare for what they think will be rising unemployment and inflation.

Hours Worked in Manufacturing. One key goal of Trump’s tariff policy is to boost jobs in U.S. manufacturing. However, while manufacturing employment may rise, it will take time, years even, for improvements to be reflected.

New Business Orders. This includes consumer goods, and orders for non-defense capital goods. The group also compiles a separate index that tracks new orders. As of the most recent report published in March, one of these components showed weakness, another was flat, and the third, slightly positive. The Trump Administration has changed its tariff policy several times in recent weeks, creating the type of uncertainty that businesses fear.

Click here to read more.

If you have questions on this topic or are in a financial crisis and considering filing for bankruptcy, contact an experienced Miami bankruptcy attorney who can advise you of all of your options. As an experienced CPA as well as a proven bankruptcy lawyer, Timothy Kingcade knows how to help clients take full advantage of the bankruptcy laws to protect their assets and get successful results. Since 1996 Kingcade Garcia McMaken has been helping people from all walks of life build a better tomorrow. Our attorneys’ help thousands of people every year take advantage of their rights under bankruptcy protection to restart, rebuild and recover. The day you hire our firm, we will contact your creditors to stop the harassment. You can also find useful consumer information on the Kingcade Garcia McMaken website at www.miamibankruptcy.com.