People in the U.S. collectively owe over $1.64 trillion in auto loan debt, with the average household owing nearly $14,000. These loans have become significantly more expensive, and interest rates have surged.

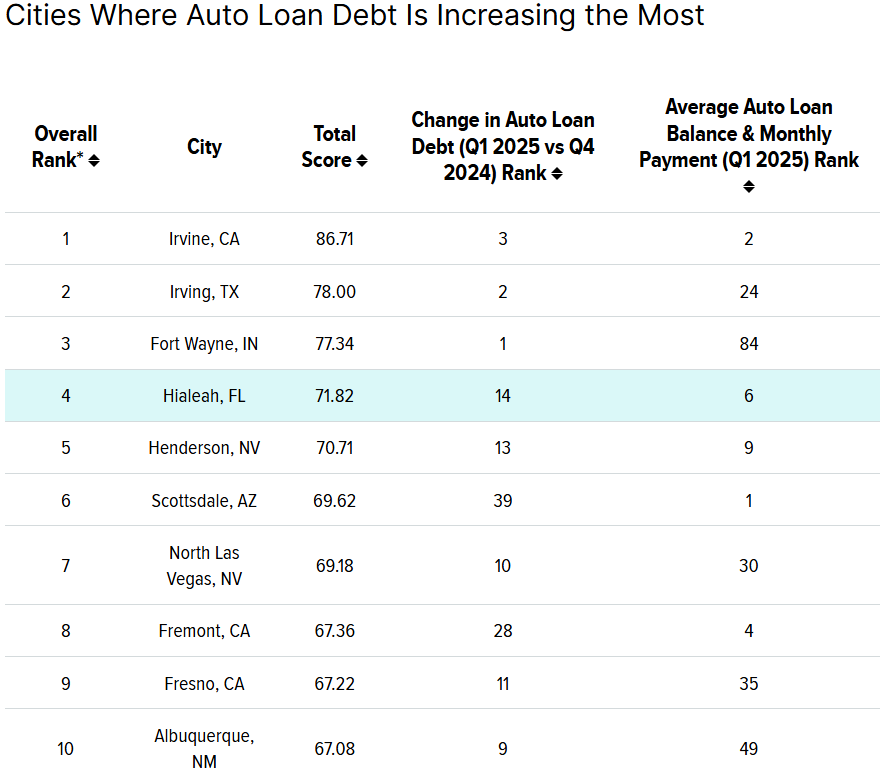

WalletHub has identified the cities where auto loan debt is growing the fastest and those where the increases are more modest by examining proprietary consumer debt data. Here are the findings:

Hialeah ranks in the Top 5 cities where auto loan debt is increasing the most. Miami comes in at #43 on the list. In most of the Top 10 cities on the list, this extra debt is a bad sign because those cities tend to have high debt delinquency rates and a lot of people experiencing financial distress.

Click here to read more.

If you have questions on this topic or are in a financial crisis and considering filing for bankruptcy, contact an experienced Miami bankruptcy attorney who can advise you of all of your options. As an experienced CPA as well as a proven bankruptcy lawyer, Timothy Kingcade knows how to help clients take full advantage of the bankruptcy laws to protect their assets and get successful results. Since 1996 Kingcade Garcia McMaken has been helping people from all walks of life build a better tomorrow. Our attorneys’ help thousands of people every year take advantage of their rights under bankruptcy protection to restart, rebuild and recover. The day you hire our firm, we will contact your creditors to stop the harassment. You can also find useful consumer information on the Kingcade Garcia McMaken website at www.miamibankruptcy.com.