Bankruptcy can be used as a powerful financial tool to eliminate debt and allow you to push the restart button on your finances However, filing for bankruptcy does not eliminate all debts and before you file it’s important to know which debts will be discharged and which ones will remain.

Here are some things filing for bankruptcy can do:

Eliminate credit card debt and other types of unsecured debt. Your credit card debt is considered unsecured debt, which means the creditor does not have a lien on any of your property and cannot repossess any items if you fail to pay the debt. This is the exact type of debt bankruptcy is designed to eliminate. Other types of unsecured debt include: utility bills, medical bills, personal loans, payday loans, etc. Most debts are unsecured. Primary exceptions are home and auto loans, which are almost always secured.

Stop creditor harassment and collection attempts. The Fair Debt Collections Practices Act (FDCPA) limits the tactics that debt collectors can take to collect on a debt. When you file for bankruptcy, the automatic stay immediately goes into effect and stops creditors from having any sort of contact with you. They must now communicate only with your attorney.

Here are some things bankruptcy cannot do:

Eliminate child support and alimony payments. Child support and alimony payments cannot be discharged in bankruptcy. You will continue to owe these debts in full.

Eliminate other non-dischargeable debts. These include debts for personal injury or death caused by intoxicated driving, fines and penalties imposed for violating the law, etc.

Eliminate student loan debt, except in very rare circumstances. Student loans can be discharged in bankruptcy only if you can show that repaying the loan would cause you “undue hardship,” an extremely difficult standard to meet. You must not only be able to show you cannot afford to pay your loans right now, but that you have very little likelihood of ever being able to repay your loans in the future.

Prevent a secured creditor from repossessing property. A bankruptcy discharge eliminates debts, but it does not eliminate liens. So for secured debts, where the creditor has a lien on your property (and can repossess it if you do not pay the debt), bankruptcy can eliminate the debt, but it cannot prevent the creditor from repossessing the property.

Click here to read more on this story.

If you have any questions on this topic or are in financial crisis and considering filing for bankruptcy, contact an experienced Miami bankruptcy attorney who can advise you of all of your options. As an experienced CPA as well as a proven bankruptcy lawyer, Timothy Kingcade knows how to help clients take full advantage of the bankruptcy laws to protect their assets and get successful results. Since 1996 Kingcade Garcia McMaken has been helping people from all walks of life build a better tomorrow. Our attorneys’ help thousands of people every year take advantage of their rights under bankruptcy protection to restart, rebuild and recover. The day you hire our firm, we will contact your creditors to stop the harassment. You can also find useful consumer information on the Kingcade Garcia McMaken website at www.miamibankruptcy.com.

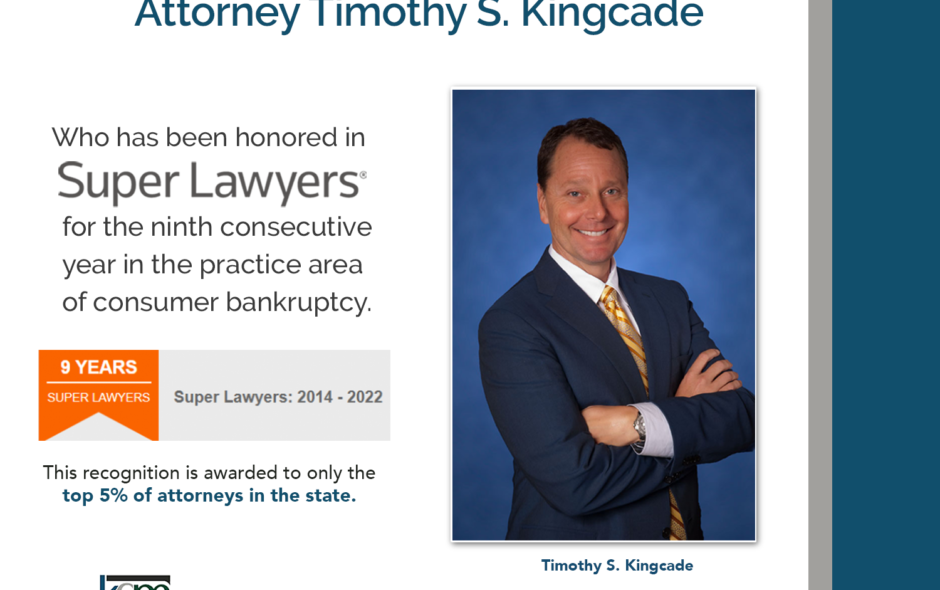

MIAMI – (March 5, 2018) Managing Shareholder, Timothy S. Kingcade of the Miami-based law firm of Kingcade Garcia McMaken (

MIAMI – (March 5, 2018) Managing Shareholder, Timothy S. Kingcade of the Miami-based law firm of Kingcade Garcia McMaken (