Debt relief and bankruptcy can offer real financial help in a challenging economic environment- but there are a few things you should know about each option.

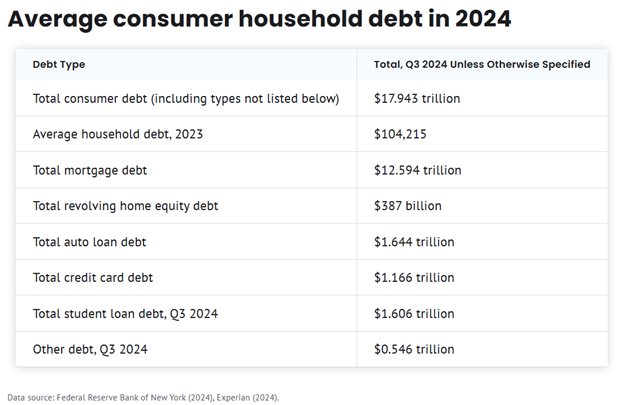

American households are struggling with debt like never before, as total credit card balances have soared past $1.21 trillion nationally. With credit card interest rates approaching record highs and the cost of living rising, many people have found themselves trapped in a cycle of making minimum payments.

Amid the financial pressure, people are exploring different options to regain control over their debt.

Debt relief programs, such as credit card settlement plans, are increasingly accessible, while bankruptcy remains an option for those facing overwhelming debt.

Each option has unique benefits, costs, and long-term implications.

Debt relief programs only address unsecured debt, like credit cards, personal loans, and medical bills. These type programs cannot help with secured debts, like a mortgage or car loan.

Bankruptcy, on the other hand, can wipe out certain unsecured debts entirely, and in some cases, provide options for addressing secured debt. Understanding exactly what you owe, and to whom is the first step in deciding which approach to choose.

Debt relief programs work best if you have a steady income that allows you to make monthly payments. If your earnings are inconsistent or barely cover your living expenses, these programs can prove challenging to sustain.

For those whose income will not support repayment, bankruptcy provides a better option. However, post-bankruptcy budgeting is essential to avoid falling back into debt.

Choosing between bankruptcy and debt relief is a personal decision influenced by your total debt, income, credit outlook, and long-term goals.

Debt relief can offer structured repayment and lower interest costs without the long-lasting credit hit of bankruptcy, but it requires discipline and consistent payments. Bankruptcy, however, can immediately wipe out your debt and provide you with a fresh financial start when debt becomes unmanageable.

As you weigh your options, it is important to review each one carefully, ideally with a financial counselor, certified debt specialist, or experienced bankruptcy attorney before deciding.

Click here to read more on this story.

If you have questions on this topic or are in a financial crisis and considering filing for bankruptcy, contact an experienced Miami bankruptcy attorney who can assist you and address all of your options. As an experienced CPA as well as a proven bankruptcy lawyer, Timothy Kingcade knows how to help clients take full advantage of the bankruptcy laws to protect their assets and get successful results. Since 1996 Kingcade Garcia McMaken has been helping people from all walks of life build a better tomorrow. Our attorneys help thousands of people every year take advantage of their rights under bankruptcy protection to restart, rebuild, and recover. The day you hire our firm; we will contact your creditors to stop the harassment. You can also find useful consumer information on the Kingcade Garcia McMaken website at www.miamibankruptcy.com.