The Federal Reserve cut its standard interest rate for the first time in nine months. Since the last cut, Americans are dealing with more inflation and a challenging job market.

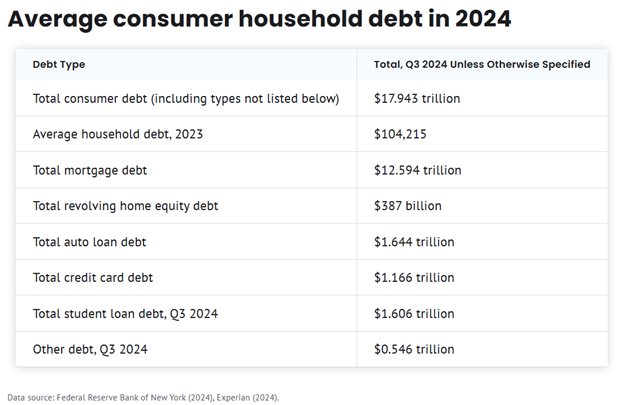

The federal funds rate, set by the Federal Reserve, is the rate at which banks borrow and lend to one another. While the rates that consumers pay to borrow money are not directly linked to this rate, shifts in Fed policy affect what people pay for credit cards, auto loans, mortgages, and other financial products.

The Fed projected it will cut rates two more times before the end of this year.

Mortgages will be affected gradually.

For prospective homebuyers, the market has already priced in the rate cut, which means it is “unlikely to make a noticeable difference for most consumers at the time of the announcement,” according to Bankrate financial analyst Stephen Kates. It is anticipated that the declining interest rate environment will provide relief for borrowers over time.

Auto loans are not expected to decline soon.

Americans have faced steeper auto loan rates since early 2022, which are not expected to decline anytime soon. Prices for new cars have leveled off recently, but remain at historically high levels, not adjusting for inflation. An auto loan annual percentage rate can run from about 4% to 30%. Bankrate’s most recent weekly survey found that average auto loan interest rates are currently at 7.19% on a 60-month new car loan.

Credit card rate relief could be slow.

Interest rates for credit cards are currently at an average of 20.13%, and the Fed’s rate cut may be slow to be felt by anyone carrying a large amount of credit card debt. The best thing for anyone carrying a large credit card balance is to prioritize paying down high-interest-rate debt, and to seek to transfer any amounts possible to lower APR cards or negotiate directly with credit card companies for accommodation.

Click here to read more.

If you have questions on this topic or are in financial crisis and considering filing for bankruptcy, contact an experienced Miami bankruptcy attorney who can advise you of all of your options. As an experienced CPA as well as a proven bankruptcy lawyer, Timothy Kingcade knows how to help clients take full advantage of the bankruptcy laws to protect their assets and get successful results. Since 1996 Kingcade Garcia McMaken has been helping people from all walks of life build a better tomorrow. Our attorneys help thousands of people every year take advantage of their rights under bankruptcy protection to restart, rebuild and recover. The day you hire our firm; we will contact your creditors to stop the harassment. You can also find useful consumer information on the Kingcade Garcia McMaken website at www.miamibankruptcy.com.