Personal bankruptcy filings are down, leaving many financial analysts questioning whether the drop in filings can be attributed to financial relief offered from governmental pandemic relief programs or to other economic factors. This stimulus relief offered consumers a much-needed financial boost, but the question remains how long this boost will hold off future bankruptcy filings.

Tag: Covid-19 debt relief

U.S. Bankruptcy Filings Drop 38 Percent

Bankruptcy filings are on the decline, according to a recent report. Statistics released by the Administrative Office of the U.S. Courts, reveal bankruptcy filings dropped 38.1 percent for the 12-month period ending March 31, 2021. This dramatic drop in filings coincides with the COVID-19 pandemic, which first disrupted the economy in March 2020.

Bankruptcy filings fell for both personal and business bankruptcies. Non-business filings fell by a total of 38.8 percent, while business filings fell 13.9 percent.

Debt Collection Lawsuits Pause While One Debt Collector Continues to Pursue Collections

At the start of the COVID-19 pandemic, most debt collectors hit the pause button on collection lawsuits due to widespread national lockdowns. However, one of the largest debt collectors, Sherman Financial Group, continued to pursue its collection efforts.

According to a study conducted by the Wall Street Journal, Sherman Financial Group had the largest increase of any debt collection firm between March 15, 2020 and December 31, 2020. The study analyzed filings from five state-court districts from the start of the pandemic to the end of 2020. The number of filings went up by 52 percent from the previous year. In comparison, debt collection filings went down by 24 percent with respect to the industry overall.

The Impact the Coronavirus has had on Bankruptcy Filings in Miami Beach

The economic impact caused by the coronavirus (COVID-19) pandemic has been substantial throughout the country, and Miami Beach is not excluded. Countless businesses have been forced to close temporarily and many even permanently. While technically the number of bankruptcies were down at the end of 2020 nationwide, financial experts fear that the number of bankruptcy filings will increase over the next several years.

While the number of consumer bankruptcies were down nationwide, the number of Chapter 11 business bankruptcies saw an increase of 18.7 percent when compared to 2019. This form of bankruptcy is normally used by businesses that hope to stay in operation through the Chapter 11 bankruptcy process that allows them to renegotiate their debts. Several larger businesses, including Neiman Marcus and J.C. Penney filed for Chapter 11 in 2020.

Specifically, in Florida, a total of 37,776 bankruptcies were filed in 2020, which is 19.26 percent lower than the 46,786 filed in 2019. Of all the bankruptcy cases filed in 2020, businesses accounted for four percent of these cases. This number may seem small, but business bankruptcies tend to have a significant effect far past the bankruptcy case alone, including the effect these closures and filings have on the individual employees who lost their job as a result.

Many times, a ripple effect can be seen on other businesses after one or more close.

According to figures from the U.S. Courts Administrative Office, a total of 7,430 bankruptcies were filed in Miami-Dade County in 2020. This figure is slightly less than the 8,705 filed in 2019.

While consumer bankruptcies were down in Miami-Dade County, the number of business bankruptcies saw a slight increase. It is reported that 322 Miami area business bankruptcies were filed in 2020, as compared to 215 filed in 2019. Of these cases filed in 2020, 188 of them were filed under Chapter 7, commonly referred to as a liquidation bankruptcy. Only 129 Chapter 7 business cases were filed in 2019.

Miami-Dade County did see an increase in the number of Chapter 11 bankruptcy case filed in 2020. Approximately 120 were filed in 2020, as compared to the 62 filed in 2019.

Individual consumer bankruptcies in Miami-Dade County did not see the same increase, however. According to court filings, a total of 7,108 non-business consumer bankruptcy cases were filed in 2020, as compared to the 8,490 filed in 2019. Of these cases, 4,841 were Chapter 7 filings and 2,260 were Chapter 13 filings. In comparison, 5,067 Chapter 7 cases were filed while 3,414 Chapter 13 cases were filed in 2019.

Despite the decrease between 2019 and 2020, financial experts predict these numbers will continue to increase through 2021 and beyond. As the COVID-19 pandemic continues, more and more businesses and individuals will continue to feel the economic impact of this crisis.

Please click here to read more.

If you have questions on this topic or are in financial crisis and considering filing for bankruptcy, contact an experienced Miami bankruptcy attorney who can advise you of all of your options. As an experienced CPA as well as a proven bankruptcy lawyer, Timothy Kingcade knows how to help clients take full advantage of the bankruptcy laws to protect their assets and get successful results. Since 1996 Kingcade Garcia McMaken has been helping people from all walks of life build a better tomorrow. Our attorneys’ help thousands of people every year take advantage of their rights under bankruptcy protection to restart, rebuild and recover. The day you hire our firm, we will contact your creditors to stop the harassment. You can also find useful consumer information on the Kingcade Garcia McMaken website at www.miamibankruptcy.com.

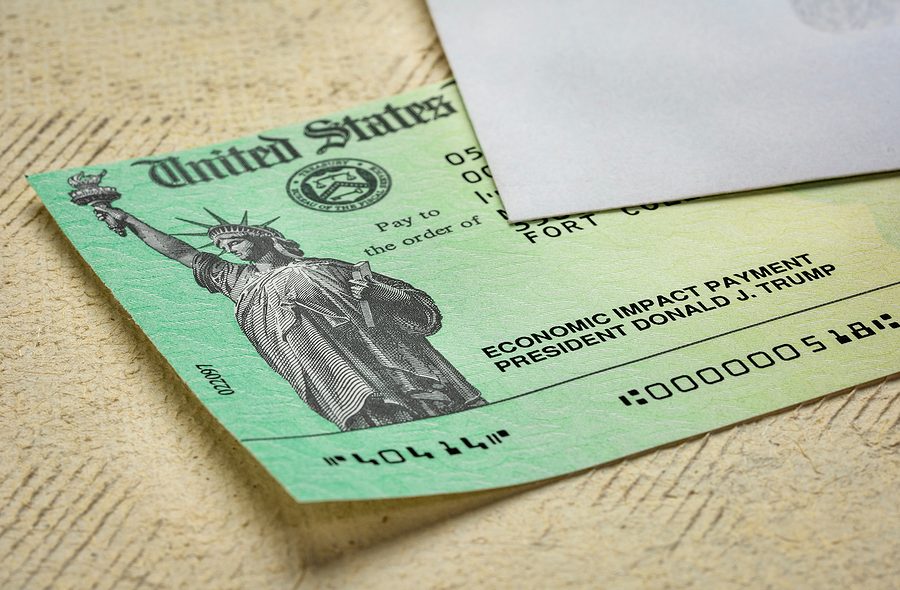

Floridians Hope to Receive Relief from Second Round of Stimulus Payments

As coronavirus (COVID-19) continues to affect the economy, many have been wondering when another relief package would be passed by Congress. After the CARES Act was passed in March 2020, providing the first source of stimulus payments, consumers have been anticipating a second source of stimulus payments to help during their continuing financial struggles. Fortunately, at the end of December 2020, a second stimulus relief package was passed by Congress and signed by the President, providing them with a sense of reprieve.

As compared the $2 trillion CARES Act passed last March, this second package totals $900 billion. Additionally, while the previous package provided $1,200 per taxpayer, this new bill provides $600 per individual making less than $75,000 annually. The new legislation provides $600 per child, while the previous legislation provided $100 less per child.

November Personal Bankruptcy Filings Drop to a 14-Year Low

Personal bankruptcy filings reported in the country for the month of November hit a low not seen in 14 years. Financial analysts believe the drop in personal bankruptcy filings can be attributed to the current national and statewide moratoriums on evictions and foreclosures, as well as the availability of governmental stimulus aid related to the coronavirus (COVID-19) pandemic.

According to figures from the legal services provider, Epiq Systems, Inc., the total number of personal bankruptcy filings in the month of November amounted to 34,440 filings. This is the lowest monthly total reported since January 2006.

Stimulus Relief Fails to Save Hundreds of Businesses

The financial ramifications of the COVID-19 pandemic have been significant for countless businesses throughout the United States. At the start of the pandemic, federal stimulus funds were issued in various forms to help businesses survive the economic crisis. However, as the virus continues, many of these businesses are being forced to close.

According to a Wall Street Journal analysis of legal filings and government data, over 300 U.S. companies that received approximately half a billion dollars in stimulus relief have also filed for bankruptcy this year. These 300 companies employ a total of 23,400 workers who are being adversely affected.

How the Pandemic is Changing Americans’ Credit Card Habits

The coronavirus (COVID-19) pandemic has changed the way of life for consumers in both good and bad ways. One change has to do with the way Americans utilize their credit cards post-pandemic.

A recent study conducted by Money and Morning Consult surveyed how American consumers have been using their credit cards during this crisis. What the study found was Americans are continuing to use their cards. However, the way by which they are using their cards has changed.