One of the major issues at the center of the 2020 Presidential Election is student loan debt, an issue that affects 44 million American borrowers. Each of the Democratic presidential candidates have his or her own proposal on how to handle this massive issue that seems to be growing every year. Some of these plans would reduce the outstanding balances borrowers hold while others call for a complete elimination of the debt.

It is said that student loan balances have surpassed credit card debt and auto debt. The average undergraduate college graduate leaves school with at least $30,000 in student loan debt, which is triple what graduates had in the 1990s. Every day, 3,000 borrowers go into default on their student loans, which is why all the candidates are calling for some level of reform.

Presidential candidate, Senator Bernie Sanders, is proposing a complete elimination of the country’s $1.6 trillion in student loan debt, basically lifting the burden from all borrowers. On the other hand, Senator Elizabeth Warren proposes eliminating debt based on household income. Under Warren’s plan, borrowers who have household incomes of less than $100,000 would receive $50,000 in student loan forgiveness. Borrowers with household incomes between $100,000 and $250,000 will receive forgiveness on a sliding scale, starting at $50,000 and dropping $1 for every $3 a person earns over $100,000. If someone earns $250,000 or more in household income, the borrower is not eligible for debt forgiveness.

For many candidates, the $100,000 income level is a threshold for receiving loan forgiveness. Another candidate, Senator Kamala Harris’s plan could potentially forgive student loan debt for families who earn less than $100,000 annually.

The call for student loan reform has come from both parties. In fact, just last week, a senior government official appointed under Department of Education Secretary Betsy DeVos resigned from his post saying that the current student loan system is broken and calling for widespread loan forgiveness. The official, A. Wayne Johnson, called for $50,000 in loan forgiveness debt for all borrowers. Student loan forgiveness at this level would result in approximately $925 billion in loan forgiveness in total.

The current federal student loan borrowing system is regulated by the Higher Education Act. The law is routinely updated every four to five years, and Democrats in the House of Representatives have recently introduced a plan to update the bill even more, which could result in relief for borrowers. Both parties have expressed an interest in also simplifying repayment plans that are out there for borrowers. Currently, 14 different plans exist by which to repay student loans, which needlessly complicates the situation and often leads to defaults. Both parties have expressed interest in reducing the number of repayment plans to two.

Another issue brought up by both parties has to do with the origination fees that are taken out on all student loans issued. The borrower may believe he or she is taking out a set amount, but that amount may be reduced by the origination fee.

Democratic lawmakers wish to also cut interest rates on student loan debt and to make it easier for borrowers to refinance their debt to benefit from a lower rate, making it easier to pay down the debt eventually.

One last major point of contention has to do with how student loans have traditionally been handled in bankruptcy. Democratic presidential candidates are calling for student loan debt to be treated in the same way other debts are in bankruptcy, meaning the debt can be discharged during normal bankruptcy proceedings. Currently, borrowers must meet the inconsistent and unclear “undue hardship” test when requesting a discharge of their student loans.

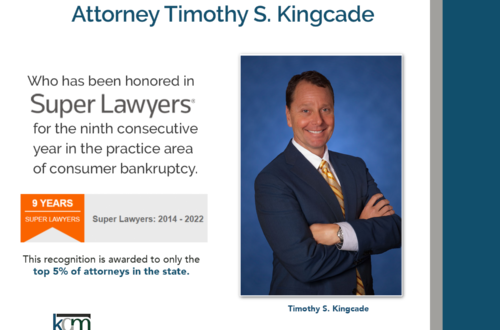

For borrowers who are struggling with student loan debt, relief options are available. Many student loan borrowers are unaware that they have rights and repayment options available to them, such as postponement of loan payments, reduction of payments or even a complete discharge of the debt. There are ways to file for bankruptcy with student loan debt. It is important you contact an experienced Miami bankruptcy attorney who can advise you of all your options. As an experienced CPA as well as a proven bankruptcy lawyer, Timothy Kingcade knows how to help clients take full advantage of the bankruptcy laws to protect their assets and get successful results. Since 1996 Kingcade Garcia McMaken has been helping people from all walks of life build a better tomorrow. Our attorneys help thousands of people every year take advantage of their rights under bankruptcy protection to restart, rebuild and recover. The day you hire our firm, we will contact your creditors to stop the harassment. You can also find useful consumer information on the Kingcade Garcia McMaken website at www.miamibankruptcy.com.

Source: CNBC.com