The Biden administration has issued a word of caution to consumers about the growing concerns they have behind medical credit cards and other loans used to pay down medical bills. These concerns have been expressed in a new report published, which warns consumers that high interest rates on these cards can only increase the patient’s debt and eventually threaten their financial situation.

In the report, issued by the Consumer Financial Protection Bureau (CFPB), they reported that U.S. consumers paid $1 billion in deferred interest on medical credit cards and other types of medical financing between the years 2018 and 2020. The interest rates on these cards can be particularly high, which is why the CFPB found that medical credit card interest rates can inflate medical bills by approximately 25 percent (25%).

According to a recent investigation conducted by KFF Health News and NPR, approximately 100 million people have some medical debt. Forty-one percent (41%) of these are adult consumers. Many of these patients are desperate to pay off this debt, which is why many of them get trapped in patient financing to pay down these debts.

In their investigation, KFF Health News found that a major problem regarding medical debt financing has to do with the private equity firms and banks who are behind these loans or credit cards. In fact, in the patient financing industry, they found that profit margins neared 29 percent (29%), which is seven times what is considered a good hospital profit margin.

One of these medical debt credit cards is CareCredit, a financing option offered by Synchrony Bank. This card is often marketed in waiting rooms across the country to help patients pay their outstanding medical bills. In 2013, the CFPB issued sanctions against CareCredit, ordering them to create a $34.1 million reimbursement fund for consumers who the agency said were victims of “deceptive credit card enrollment tactics.”

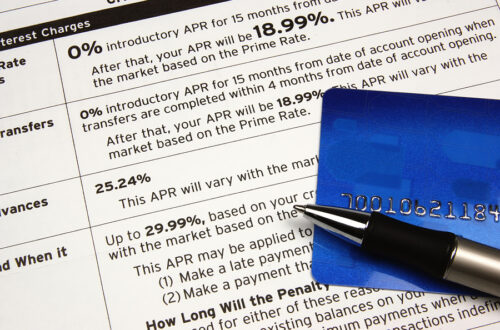

These medical cards normally offer a promotional period. During this time, patients pay their debts with no interest rate accruing. However, in the unfortunate circumstance where the patient misses a payment or is not able to finish paying the debt during the promotional period, they will suddenly find themselves with an interest rate as high as 27 percent. With an interest rate that high, it can be next to impossible to ever pay down the debt in full.

While this new report does not recommend sanctions against any lenders currently, they still caution patient borrowers from taking out loans or signing onto medical credit cards to pay down their debts.

The report also found that the risks of being trapped in a financing scheme are higher for lower-income borrowers and borrowers who have poor credit. The CFPB found that one-fourth (1/4th) of people with low credit scores who signed up for a deferred-interest medical loan were not able to pay off the debt before the promotional period ended and interest rates skyrocketed, in comparison to the 10 percent (10%) of borrowers with excellent credit who failed to avoid the higher interest rates.

One of the biggest dangers of medical credit cards are the misconceptions associated with them. A number of patients think they are setting up an installment plan with the doctor’s office. Many do not understand they have opened up a new line of credit with sky-high interest rates and strict penalties for even a single missed payment.

Most of these cards feature a “zero interest” promotional period for up to 18 months. But then the interest rate can jump to 25 percent or higher. Some consumers never received a copy of the credit card terms and had to rely on explanations from medical staffers who had little training on the card details, in cases cited by U.S. authorities.

Another potential drawback is something called deferred interest. That means if a patient does not pay off the entire balance during the “interest-free” period, they can be retroactively charged for interest dating back to when they first signed up.

Before you sign up for a medical credit card, we advise that you research other options first. Medically necessary procedures may be available at a discounted rate or even for free at certain hospitals that provide some level of charitable care. If it is not medically necessary, consider waiting until you can afford the procedure. If you must use a credit card to pay for a procedure, use one that has terms and conditions you understand.

The CFPB found that instead of actually benefiting consumers as they claim these products do, they end up putting consumers in a worse financial situation than they were in before. If you have medical debt, the best option is to work out a payment plan with the doctor’s office or hospital.

Please click here to read more.

Those who have experienced illness or injury and found themselves overwhelmed with medical debt should contact an experienced Miami bankruptcy attorney. In bankruptcy, medical bills are considered general unsecured debts just like credit cards. This means that medical bills do not receive priority treatment and can easily be discharged in bankruptcy. Bankruptcy laws were created to help people resolve overwhelming debt and gain a fresh financial start. Bankruptcy attorney Timothy Kingcade knows how to help clients take full advantage of the bankruptcy laws to protect their assets and get successful results. Since 1996 Kingcade & Garcia, P.A. has been helping people from all walks of life build a better tomorrow. Our attorneys’ help thousands of people every year take advantage of their rights under bankruptcy protection to restart, rebuild and recover. The day you hire our firm, we will contact your creditors to stop the harassment. You can also find useful consumer information on the Kingcade & Garcia website at www.miamibankruptcy.com.