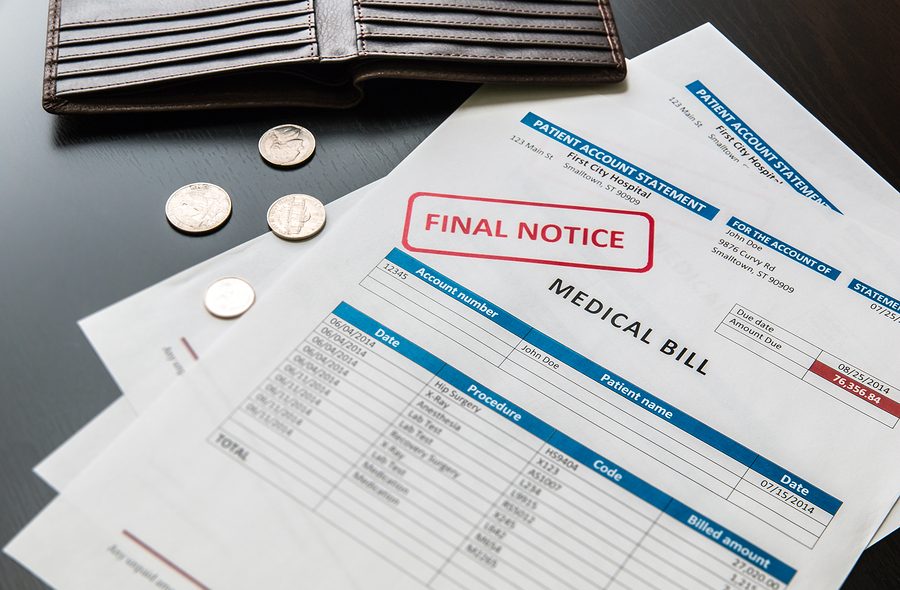

Carrying any amount of debt can be stressful, but carrying substantial amounts of debt can be debilitating to a consumer’s emotional well-being. Debt can cause anxiety and depression, and the longer a person carries it, the more likely he or she will feel physical and emotional effects from it. A recent study highlighted just how severe the effects of insurmountable debt can be.

The data reviewed comes from the 2021 BC Consumer Debt Study released by BC Licensed Insolvency Trustees Sands & Associates. They surveyed over 1,700 consumers throughout British Columbia who declared personal bankruptcy or legally consolidated a debt.

The survey noted two specific trends regarding consumer debt. The largest proportion, approximately 32 percent, of people who responded to the survey said that they had had $25,000 to $49,999 of debt, not including mortgages or car loans.

Four out of five surveyed said they found that the main causes of their debt were completely outside of their control. For example, 18 percent reported that their debt grew to the amount it was due to them needing to rely on credit to pay for essential costs of living that their income could not cover. Additionally, others reported that their debt was caused by other issues outside of their control, such as illness or health-related problems, the breakdown of a marriage or relationship, and job-related issues.

Of the consumers surveyed, more than 56 percent of them said that credit card debt was their largest source of debt before they entered formal proceedings to eliminate their debts. Payday loans were the main source of debt for approximately six percent of those polled.

Individuals surveyed reported that being in such deep debt negatively affected their well-being. In terms of emotional well-being, 77 percent said their mental health suffered. Four out of five individuals said they constantly worried about being in debt. Three in four surveyed said debt caused them anxiety.

Even more concerning, one in six individuals surveyed said that the stress of carrying large amounts of debt resulted in them contemplating or thinking of suicide.

Mental health was not the only thing affected by debt. Fifty-three percent said that their physical health likewise suffered.

One major issue occurs when the consumer is not truly aware of how much he or she actually owes, resulting in the individual’s finances spiraling out of control. The stress that results from this debt can be debilitating to the person’s mental well-being. Approximately 68 percent reported that they concluded that debt was a major problem when it became a source of major stress in their lives. Sixty percent (60%) said they realized debt was a problem when they could only make minimum payments, while fifty percent (50%) said they realized debt was a major problem when their balances never went down from month to month. Unfortunately, at that point, their debt had grown to a figure that they could not control, forcing them into either bankruptcy or other sources of debt relief.

For more information, the full study can be accessed here.

If you have questions on this topic or are in financial crisis and considering filing for bankruptcy, contact an experienced Miami bankruptcy attorney who can advise you of all of your options. As an experienced CPA as well as a proven bankruptcy lawyer, Timothy Kingcade knows how to help clients take full advantage of the bankruptcy laws to protect their assets and get successful results. Since 1996 Kingcade Garcia McMaken has been helping people from all walks of life build a better tomorrow. Our attorneys’ help thousands of people every year take advantage of their rights under bankruptcy protection to restart, rebuild and recover. The day you hire our firm, we will contact your creditors to stop the harassment. You can also find useful consumer information on the Kingcade Garcia McMaken website at www.miamibankruptcy.com.