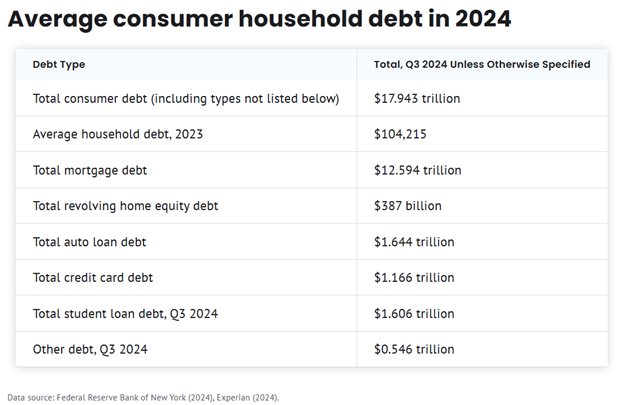

American household debt stands at a whopping $17.943 trillion dollars. Mortgage debt makes up 70% of that. Inflation has contributed to more debt and the average debt rising in nearly every category compared to 2020. This includes total household debt, credit card debt, mortgage debt, and auto loan debt. Total debt is up by over $2.5 trillion since 2020.

According to the latest Household Debt and Credit survey, Americans owe $1.166 trillion in credit card debt as of the third quarter of 2024. That’s a record high, up from $1.162 trillion in the second quarter. Americans had an average of $6,501 in in credit card debt in the third quarter of 2023, according to Experian.

Based on data from the second quarter in 2023, Gen X carries the highest average credit card balance, $8,870, while Gen Z carries the lowest average credit card balance, with $3,148.

Paying off debt and finding relief.

It may seem like you have too much debt to ever get out of. However, the first step is to address your debt. Understand the total amount of debt you have. From there you can determine what type of debt you hold, like credit card debt, mortgage, or auto loan. Then it is important to note how much you owe, what the interest rate is, and what the minimum payment amount is for each type of debt you own.

As bankruptcy attorneys, we see credit card debt as one of the most common problems facing those with serious financial challenges.

Filing for bankruptcy is a viable option for those struggling with insurmountable credit card debt. Chapter 7 is the fastest form of consumer bankruptcy and forgives most unsecured debts like credit card debt, medical bills, and personal loans.

If you have questions on this topic or are in financial crisis and considering filing for bankruptcy, contact an experienced Miami bankruptcy attorney who can advise you of all of your options. As an experienced CPA as well as a proven bankruptcy lawyer, Timothy Kingcade knows how to help clients take full advantage of the bankruptcy laws to protect their assets and get successful results. Since 1996 Kingcade Garcia McMaken has been helping people from all walks of life build a better tomorrow. Our attorneys help thousands of people every year take advantage of their rights under bankruptcy protection to restart, rebuild and recover. The day you hire our firm; we will contact your creditors to stop the harassment. You can also find useful consumer information on the Kingcade Garcia McMaken website at www.miamibankruptcy.com.

SOURCE: Average American Household Debt in 2024: Facts and Figures