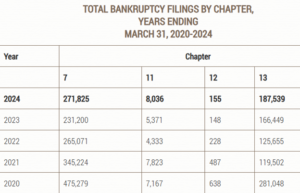

Bankruptcy filings rose 16 percent during the 12-month period ending March 31, 2024.

Factors contributing to the increase include higher interest rates, a reduction in consumer discretionary spending, higher housing costs, and a continued drawdown of excess savings. The trend is expected to continue through 2024.

According to statistics released by the Administrative Office of the U.S. Courts, total filings rose to 467,774 new cases, compared with 403,273 cases reported during the year ending March 31, 2023.

Business filings increased 40.4 percent, from 14,467 in March 2023 to 20,316 in the newest report. Non-business filings rose 15.1 percent, from 388,806 in March 2023 to 447,458 in March 2024.

This year’s 12-month filing total for the quarter ending March 31 is nearly three-fifths of the total reported in March 2020, when the pandemic disrupted the U.S. economy. That year’s 12-month total was 764,282.

If you have questions on this topic or are in financial crisis and considering filing for bankruptcy, contact an experienced Miami bankruptcy attorney who can advise you of all of your options. As an experienced CPA as well as a proven bankruptcy lawyer, Timothy Kingcade knows how to help clients take full advantage of the bankruptcy laws to protect their assets and get successful results. Since 1996 Kingcade Garcia McMaken has been helping people from all walks of life build a better tomorrow. Our attorneys help thousands of people every year take advantage of their rights under bankruptcy protection to restart, rebuild and recover. The day you hire our firm, we will contact your creditors to stop the harassment. You can also find useful consumer information on the Kingcade Garcia McMaken website at www.miamibankruptcy.com.

SOURCE:

Bankruptcies Rise 16 Percent Over Previous Year | United States Courts (uscourts.gov)