Americans owe a whopping $1.13 trillion on their credit cards. The total increased by 4.6% in the third quarter of 2023. When it comes to credit card debt, consumers are maxed out.

All stages of credit card delinquency (30, 60 and 90 days past due) jumped during the third quarter of last year, surpassing pre-pandemic levels for the first time, according to a recent report by the Federal Reserve Bank of Philadelphia.

This means a number of consumers are revolving all or part of their credit card balance every month. As of the third quarter, 33.18% of accounts paid off their balance in full. That’s the lowest share since the fourth quarter of 2020, Philadelphia Fed data show.

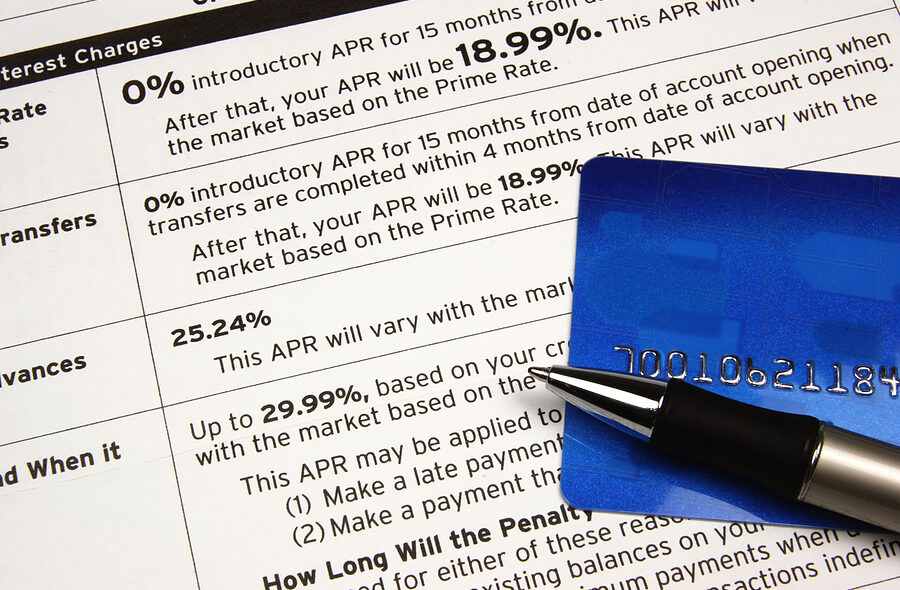

A nearly three-year stretch of high inflation has sent consumer debt into overdrive. Towards the end of last year, outstanding credit card balances surpassed the $5 trillion mark for the first time, according to Federal data. These rising delinquencies are becoming painfully expensive for many consumers. Interest rates are the highest they have been in two decades.

As bankruptcy attorneys, we see credit card debt as one of the most common problems facing those with serious financial challenges. It is not surprising with the high interest rates, unreasonable fees, harassing debt collection calls, penalties and never-ending minimum payments that do not even make a dent in your actual debt.

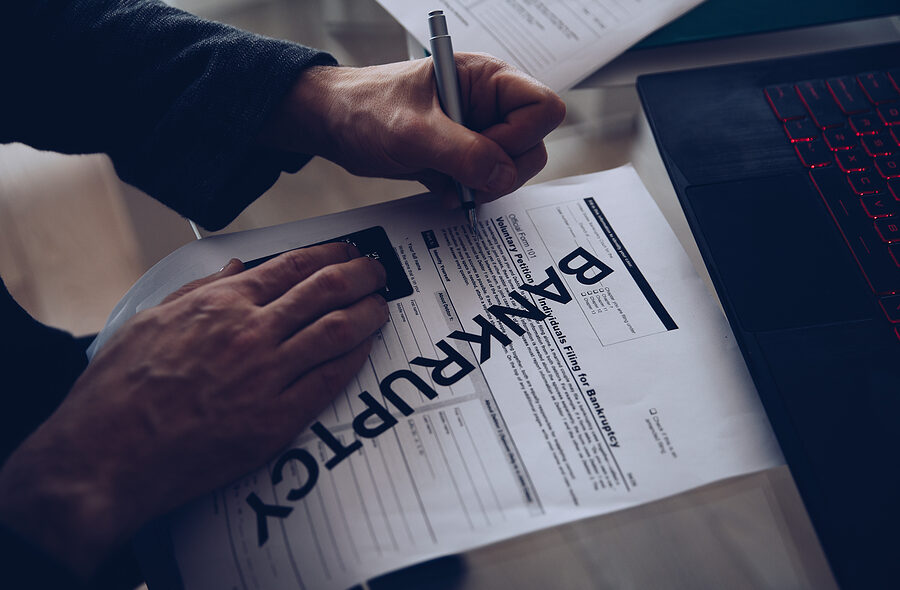

Filing for bankruptcy is a viable option for those struggling with insurmountable credit card debt. Chapter 7 is the fastest form of consumer bankruptcy and forgives most unsecured debts like credit card debt, medical bills, and personal loans. There are certain qualifications a consumer must meet in regard to income, assets, and expenses to file for Chapter 7 bankruptcy, which is determined by the bankruptcy means test.

SOURCE: Credit Card Delinquencies Surpass Pre-Pandemic Levels – CNN (January 11, 2024)