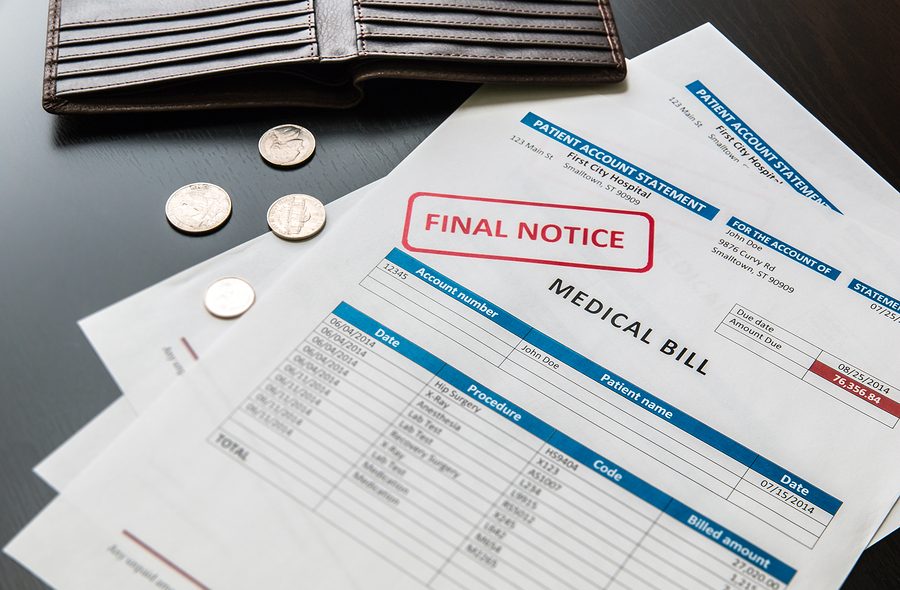

It only takes one medical crisis to set you back thousands of dollars. In fact, medical debt is the number one reason people file for bankruptcy. Many times, consumers have no idea that the medical bill is coming or how much it will be. In fact, according to a study from Consumer Reports, more than one-fourth of Americans who have health insurance have received one of these “surprise” medical bill in the mail.

In the past, as soon as an individual failed to pay a medical bill, the medical service provider could report the individual to a credit reporting agency.

However, new rules for the big three credit agencies, which include Equifax, Experian, and TransUnion, now require these agencies to wait 180 days before reporting an unpaid medical bill to a credit reporting agency. This waiting period gives individuals time to properly investigate the bill. If, after a dispute, the insurance company pays the bill, but the provider has already reported the claim to a credit reporting agency, the default will need to be taken off the credit report.

Unpaid medical bills affect your credit score. Typically, doctors and hospitals do not report debts to credit bureaus. Instead, they turn their unpaid bills over to a debt collector and it is the collection agency that reports them. Just one collection account can cause a good credit score to drop 50 to 100 points. Medical collections are no exception. Medical debt can remain on your credit report for up to seven years from the date of delinquency.

It is important that you routinely monitor your credit report to ensure there are no inaccuracies. If a claim has been properly disputed with the medical provider or insurance company but still appears on the credit report, you will need to contact the medical provider to get proof of payment and then submit this proof to get the debt removed from your credit report.

If you receive a medical bill that you are not able to pay, it is extremely important that you do not ignore the bill. If you are not able to make a full payment on the bill, it is important that you communicate this fact as soon as possible with the medical provider. Most healthcare providers are willing to work with you. At the end of the day, these providers would prefer to receive payment in lieu of going through collections to get their money.

Ignoring a medical bill can result in a lawsuit being filed against you. If you fail to address the legal case, the medical provider will get a judgment by default and will be able to garnish your wages as a result. If a lawsuit has been filed against you for an outstanding medical debt, it is important that you contact an attorney as soon as possible to protect your rights.

Click HERE to read more on this story.

Those who have experienced illness or injury and found themselves overwhelmed with medical debt should contact an experienced Miami bankruptcy attorney. In bankruptcy, medical bills are considered general unsecured debts just like credit cards. This means that medical bills do not receive priority treatment and can easily be discharged in bankruptcy. Bankruptcy laws were created to help people resolve overwhelming debt and gain a fresh financial start. Bankruptcy attorney Timothy Kingcade knows how to help clients take full advantage of the bankruptcy laws to protect their assets and get successful results. Since 1996 Kingcade Garcia McMaken, P.A. has been helping people from all walks of life build a better tomorrow. Our attorneys’ help thousands of people every year take advantage of their rights under bankruptcy protection to restart, rebuild and recover. The day you hire our firm, we will contact your creditors to stop the harassment. You can also find useful consumer information on the Kingcade & Garcia website at www.miamibankruptcy.com.