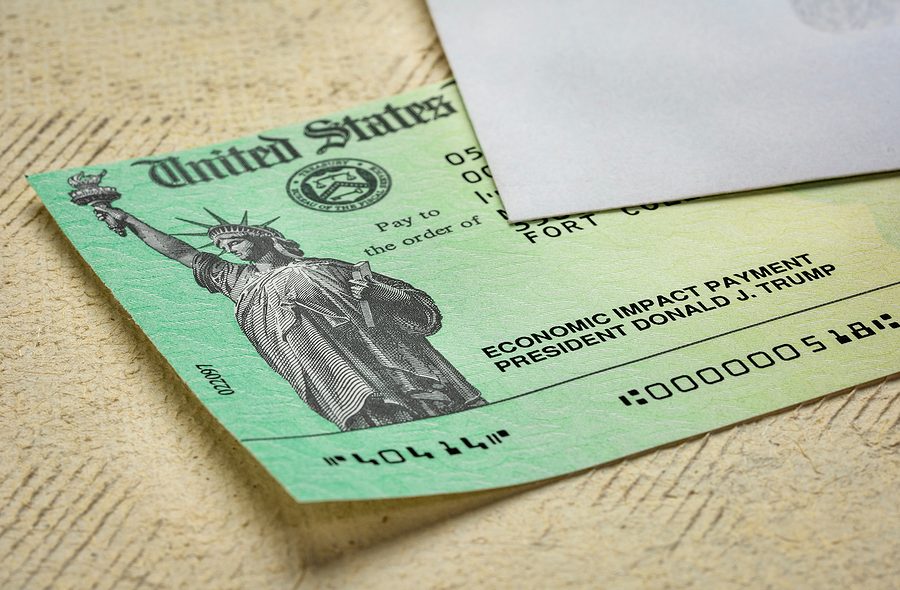

Changes are on the horizon for student loans in 2021. Student loan reform has been an issue discussed for years, if not decades, but several events that occurred in 2020 have pushed the issue to the forefront. The presidential election, the coronavirus (COVID-19) outbreak, and the current economic climate have all pushed lawmakers to realize that student loan reform is a very real issue, and one that requires immediate action. The following possible changes could be coming in the new year.

Student Loan Cancellation

A number of recent legislative proposals have brought up the idea of student loan forgiveness. One proposal was included in the Heroes Act stimulus package proposed by House Democrats. In the legislation, lawmakers proposed to cancel up to $10,000 in student loan debt for borrowers who could demonstrate that they were struggling financially. Unfortunately, even though the legislation moved forward to the Senate, this portion of the original bill was removed. Senators Elizabeth Warren (D-MA) and Chuck Schumer (D-MA) have proposed legislation that would cancel $50,000 in student loan debt for borrowers who earn less than $125,000 in annual income. Lawmakers have pushed on President Elect Joe Biden to make a statement as to whether he supports or does not support student loan cancellation. Biden has stated that he would not likely pursue an executive order to cancel student loans, but rather, he encouraged Congress to consider immediate cancellation of $10,000 of student loans across the board. However, the fate of this proposal hinges on whether Republicans will retain control over the Senate. If they do, it is unlikely that student loan cancellation will move forward.