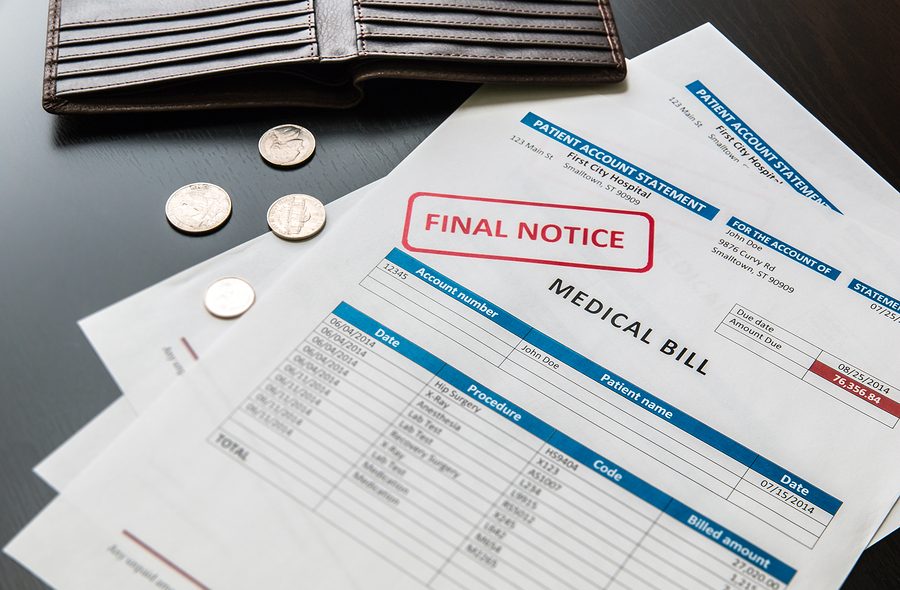

Medical debt is the single largest cause of bankruptcy in America, according to the National Consumer Law Center (NCLC). Even if a person has medical insurance, most consumers have high deductible plans which require them to pay thousands of dollars upfront before their insurance will cover their medical expenses.

This fact could be why approximately 18 percent of all American consumers have some type of medical debt that is currently in collections, according to a recent study by the Journal of the American Medical Association. Between the years 2009 and 2020, unpaid medical bills were the largest source of debt being serviced by third-party debt collection agencies.

One of the biggest reasons for these debts being in collection involves a practice known as surprise billing. Surprise billing occurs when the customer receives a medical bill showing that a medical expense is significantly more than anticipated. The last thing a consumer wants to experience is an unpleasant surprise in the mail in the form of a bill showing that a hospital that he or she thought was in-network was, in fact, not in the person’s insurance network. The U.S. Department of Health and Human Services reports that millions of American consumers have experienced surprise medical billing.

Often, even if a consumer believes that he or she is being seen at an in-network hospital, many times the doctors at that hospital are not in-network. They may be working at the hospital on a contract basis, being employed by a staffing firm and not the hospital itself. Once the individual is healthy and out of the hospital, he or she may soon discover that the expenses incurred during that stay were not covered by his or her insurance. This practice has become more common as private equity firms invest in the healthcare industry and look for methods to increase billing charges.

Consumers will find themselves protected from this billing practice in the near future, as of January 1, 2022, under the new “No Surprise Act.”

The No Surprises Act protects people covered under group and individual health plans from receiving surprise medical bills when they receive most emergency services, non-emergency services from out-of-network providers at in-network facilities, and services from out-of-network air ambulance service providers. It also establishes an independent dispute resolution process for payment disputes between plans and providers, and provides new dispute resolution opportunities for uninsured and self-pay individuals when they receive a medical bill that is substantially greater than the good faith estimate they get from the provider.

TIt is expected that the No Surprise Act will reduce overall healthcare costs, ensuring that consumers are paying a reasonable market rate for any medical services received.

Please click here to read more.

Those who have experienced illness or injury and found themselves overwhelmed with medical debt should contact an experienced Miami bankruptcy attorney. In bankruptcy, medical bills are considered general unsecured debts just like credit cards. This means that medical bills do not receive priority treatment and can easily be discharged in bankruptcy. Bankruptcy laws were created to help people resolve overwhelming debt and gain a fresh financial start. Bankruptcy attorney Timothy Kingcade knows how to help clients take full advantage of the bankruptcy laws to protect their assets and get successful results. Since 1996 Kingcade Garcia McMaken, P.A. has been helping people from all walks of life build a better tomorrow. Our attorneys’ help thousands of people every year take advantage of their rights under bankruptcy protection to restart, rebuild and recover. The day you hire our firm, we will contact your creditors to stop the harassment. You can also find useful consumer information on the Kingcade Garcia McMaken, P.A. website at www.miamibankruptcy.com.